Preparing portfolios for after the pandemic

How to establish which sectors to favour, as we emerge from the crisis

As we emerge out of lockdown, many are asking where they should be investing in the future, and which kinds of stocks are going to do well.

So much has been in flux over the past year and half, that stocks that have done well during the pandemic, are not guaranteed to continue that way once we emerge out of lockdown.

While we have all been making use of technology, those companies' share prices have soared.

But the big spectre looming is inflation. No one knows exactly how people will behave, once they are allowed to go out and spend money. The question is: will they spend in the same way as before; spend more, due to frustration over the last year; or be more cautious?

There are many other economic factors influencing inflation, but it is highly likely that as we transition to something more akin to normality, the areas to invest in will change as well.

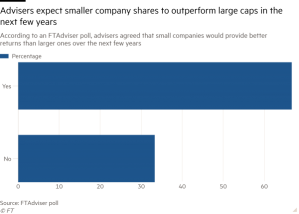

The coming economic recovery is likely to lead to the outperformance of smaller company shares, according to the latest FTAdviser poll.

The poll was conducted via FTAdviser’s Twitter account. The result was that almost exactly two-thirds of those who responded believe small caps will outperform relative to larger companies, while around one third expect large caps to perform best.

Many smaller companies operate in areas of the market where the performance of the wider economy has a material impact on the performance of individual companies, so any substantive rebound in economic growth is likely to disproportionately help smaller company shares relative to many of the larger companies that have performed best over the past decade.

The shadow hanging over markets in recent months has been that of inflation, leading to higher bond yields, and higher yields tend to negatively impact many of the larger company equities in areas such as technology, which will earn much more of their cash in future, rather than now.

An investor in a government bond gets paid today, so if yields rise, the investor in growth equities, who gets paid far into the future, is sacrificing more today.

david.thorpe@ft.com

The outlook for equities after the pandemic

Despite the myriad uncertainties which abound during the pandemic, the market has firmly made up its mind about what is coming next.

Since the announcement in November of the first Covid 19 vaccine, the market has broadly begun to price in higher inflation and higher growth, the precise characteristics of the start of a new economic cycle.

Such a phase in markets typically leads to the underperformance of bonds and growth equities, while value shares perform strongly.

Value equities tend to be those which are most strongly linked to the performance of the wider economy, and, in particular, of inflation.

This part of the market sharply underperformed in the decade after the financial crisis, as growth rates were meagre, and general inflation in the economy was low.

Barry Norris, founder and fund manager at Argonaut Capital, says the result of policymakers' focus on using monetary policy as the principal weapon to drive the economic recovery after the crisis was that asset prices rose, but that as assets are more likely to be owned by the affluent, and, as the affluent are less likely to spend any extra wealth they acquire, this does not help the level of economic growth in the wider economy.

Lower growth rates also mean the potential for inflation to rise is limited, all circumstances which helped the returns of growth equities and bonds.

He says the response to the pandemic-induced recession has also included increased government spending, and when governments spend, this deploys cash to a larger number of people in the economy, including those who are less well off and so will have a greater propensity to spend.

This boosts economic growth and inflation, and creates precisely the desired conditions for value equities to perform better.

John Butters, chief investment officer at Wetherbys Private Bank, says that while monetary policy did create inflation after the global financial crisis, it actually created less spending power than was created by government policies in 2007 and 2008, the years immediately prior to the financial crisis, when the level of inflation was creating instability that subsequently led to a crash.

Inflation can be controlled by central banks. That position doesn't change until central banks stop controlling inflation

He says inflation is more likely now than at any time in the past decade, “but the argument is far from watertight, for two reasons.

“First, as the post-2008 period shows, the relationship between money supply and inflation has been weak in the 21st century so far.

“Second, inflation can be controlled by central banks. That position doesn't change until central banks stop controlling inflation, or politicians stop them from doing so. Inflation is a political phenomenon.

“We are investors, not forecasters, but we do tend to think that as long as central banks are allowed, and indeed required, to prevent it, inflation-doom cannot be anywhere near as certain as its prophets would have us believe."

John Leiper, chief investment officer at Tavistock, says his initial reaction to the positive news was to sell US technology shares and buy more value shares in the US, but that as economic data improved, he grew more confident about the outlook, and has started to buy UK shares.

With the relative absence of technology shares on the UK market, and the prevalence of bank and mining shares, the UK would be expected to perform better than most equity markets in a world of persistently stronger growth and inflation.

James Burns, who runs the managed portfolio service at Smith and Williamson is another who believes that value equities will continue to perform well after the pandemic.

He says the recent strong performance of value shares has narrowed the valuation gap built up by growth equities over the past decade, but feels there is still plenty of more scope for strong performance.

Burns has been buying UK value funds, such as those run by Henry Dixon at Man GLG, as he believes UK equities will be among the beneficiaries of the shift in market sentiment.

Long term trends that had been keeping inflation low, such as ageing populations and high debt levels, and technology, are not going anywhere

He says an example of the change in sentiment can be seen in the raft of recent takeover bids for UK listed companies by overseas buyers; he added many of these opportunities are in the small and midcap part of the market.

He says: “Long term trends that had been keeping inflation low, such as ageing populations and high debt levels, and technology, are not going anywhere. So I think while inflation will rise, it may prove transitory. We are overweight on UK equities and recent bid activity has reinforced our view on that."

Simon Edelsten, who jointly runs the Mid Wynd investment trust and other global equity mandates at Artemis says: “Recent inflation data is not at all surprising. Prices of various goods were depressed a year ago due to lockdown. The rebound since then has raised demand for many basic materials, especially industrial commodities: copper, iron ore, lumber etc.

“A rebound in these prices need not lead to an inflationary spiral unless labour markets also prove tight. In China demographics show fewer people coming into the workforce, but southern Europe currently has high unemployment.

“For inflation to persist for a number of years, longer term pressures would need to persist. One is the massive stimulus package announced by President Biden – could this produce overheating?

“The less discussed issue is the cost of moving to an economy with higher environmental standards – we have already seen electricity bills rise as old coal plants have been closed and more expensive renewable energy introduced.

“For an equity investor this suggests market levels are likely to be challenged as we move past a period of reliably low inflation.”

James Sullivan, head of partnerships at Tyndall says the labour market pressures Edelsten cites are starting to become evident: “We are beginning to witness green shoots of wage inflation, notably, a dearth of labour within the US market. Potential employers are offering financial incentives for interviewees just to turn up, whilst ‘signing on fees’ are becoming commonplace.

“The stimulus cheques have had unintended consequences that may yet prove to be aggressively inflationary. What this all boils down to is the prospect of higher inflation than forecast in the short term, with an increasing expectation of inflation remaining above target for the short to medium term as this phenomena feeds through the system.

“There is little doubt in my mind that portfolios should be extremely cognisant of inflation in the short to medium term.

“This is a fertile backdrop for value investing; owning more cyclically sensitive stocks that benefit from rising rates, capex and an expansion of GDP. Despite an impressive Q1 in the most part, as a genre, value remains at a significant discount to its growth cousins and one should expect to see that differential narrow over time.”

Pete Drewienkiewicz, chief investment officer for global assets at Redington, says he doesn’t expect inflation to rise high enough to have a negative impact on most clients' equity portfolios, but that at present he thinks the opportunity in value shares is beginning to diminish and so he is running a “balanced” portfolio between value and growth.

Technology shares

A feature of global equity markets since the end of the global financial crisis has been the strong performance of technology shares, in part driven by the rally in growth stocks, but among the dominant trends associated with the pandemic has been the rise in the adoption of technology as part of everyday life.

Drewienkiewicz says that while the lifestyle changes are likely to be permanent for many, the share prices of tech companies that will likely be among the beneficiaries of such changes, including Peloton and Spotify, had got out of hand and so any recent sell-off is justified.

John Husselbee, head of multi-asset investing at Liontrust says: “We remain cautious on the US. Since the market low on 23 March 2020, the S&P 500 has rallied more than 80 per cent.

“Going back 100 years, it has traditionally taken the Index around a decade to double in value, whereas the climb from 2000 to 4000 has come in less than seven years. Such rapid growth again suggests scope for pullbacks and we have already seen this happening in the most expensive (tech-focused) corners of the market.

“To clarify, we are not saying all ‘tech’ stocks are in dangerous bubble territory, but there are lessons here about herd investing.”

He believes tech share prices will grind slowly downwards in months to come, rather than crash.

Sullivan says that while technology companies are likely to continue to grow in future, it is likely they already trade at such high valuations it is difficult to see how the share price performance of the past decade can be repeated.

Emerging opportunity?

On the surface, the macroeconomic climate into which the world is about to enter is ideal for emerging market assets.

Many of those economies are commodity-based, while others are about manufacturing consumer goods.

A general rise in global GDP boosts those economies, as demand increases.

But the broader picture may also be positive, as low interest rates help those emerging market companies and countries that primarily borrow in dollars.

This is because lower rates encourage relative dollar weakness relative to the rest of the world, keeping the debt repayment costs of those companies and countries lower, increasing the scope for investment but also for shareholder returns.

The fly in the ointment for emerging economies could be if inflation rises to such a level that bond yields rise significantly further from here.

This is a negative in the short term for emerging market assets as the yield on the US government debt is the lowest risk investment return available in the world.

If the yield on those bonds rises, then the returns become more attractive, and reduce the appeal of riskier assets such as those in emerging markets.

Simon King, chief investment officer at Vermeer Partners says: “We remain positive on emerging markets in the long term due to their favourable demographics and growth profiles.

“However, they will be vulnerable to short term volatility, and it is not clear how well they will adapt to a higher inflation environment. This means short-term caution is required.”

John Moore, senior investment manager at Brewin Dolphin says: “Many believe that emerging markets are due a run. Relative performance and the dollar showing signs of weakness are often arguments put forward. Much like the debate between, say, growth and value, I would expect the role of emerging markets would be defined by opportunity to add value relative to developed markets, be that better sales or bottom line growth.

“It seems reasonable to expect that with better vaccine access and programmes, developed markets should see the immediate benefit of the return to some sort of normalisation trade, which probably defers enthusiasm for emerging markets in the short-term. Added to this, moves in China to check the rise of the largest technology companies has added a feeling of risk premium to the region despite the potential for it to be more of a timing issue for that sector and political interaction generally.

“Whilst emerging markets may potentially show the benefits of recovery and change, it may be that the timing of this means that more immediate allocation thoughts sit elsewhere.”

Chris J. Ratcliffe/Bloomberg

Chris J. Ratcliffe/Bloomberg

REUTERS/Toby Melville/

REUTERS/Toby Melville/

Michael Nagle/Bloomberg

Michael Nagle/Bloomberg

House View: Who will be the winners from the UK’s lockdown lifting?

The UK continues its steady emergence from lockdown. Shops, gyms and outdoor hospitality reopened in April, with hotels, cinemas and indoor dining now following suit. All being well, further restrictions could be lifted in June.

The lockdowns of the last year have undoubtedly benefited online grocers and food delivery services. But we've reached a crucial moment for the economy and for companies. This is the moment where we find out the extent of “pandemic fatigue” and the degree to which consumers are willing to get out and spend.

So far, the signs look very encouraging. Anyone trying to make a last-minute restaurant or pub booking for the recent bank holiday weekend would likely have been disappointed.

Anecdotally, tables seem to be booked solid despite the changeable spring weather.

It’s a similar story for fitness firms. Early media reports from the UK’s largest low-cost gym chain pointed to over one million member workouts in the week after the 12 April reopening, a similar level to the same week in 2019.

The pandemic has created severe short-term challenges for the economy but in doing so it has tested business models and allowed those with the strongest long-term potential to shine through. Investors can take advantage of this moment of clarity.

Pent-up demand within the hospitality sector

Hospitality should be an important beneficiary of pent-up demand as people start to socialise again. However, lockdowns posed an extreme challenge for the sector. Companies who are financially strong, with premises in the best locations, are likely to be the most attractive potential investment opportunities.

For example, City Pub Group runs pubs in London, cathedral cities and market towns. It owns the majority of these premises, offering a degree of security and the potential to raise finance based on these real estate assets.

The hotel industry is another that should benefit from reopening, although this could be at a slower pace, as travel for business purposes in particular may take longer to recover if working from home remains the norm.

Nonetheless, we think overall appetite for travel remains strong, especially after a year when people were largely confined to their immediate surroundings.

There is enormous scope for a bounce back. The latest figures from Visit England for February 2021 showed that the hotel occupancy rate was 29%, compared to 73% in February 2019.

Dalata Hotels Group is an example of a hotelier with a strong portfolio of hotels across the UK and Ireland, that could benefit from the reopening of both economies.

As well as the boost from activity resuming, companies in the hospitality sector who are financially robust may also have scope to expand by buying up sites from weaker competitors who have been forced to exit the market.

Time to travel

The reopening of travel channels should also mean higher passenger numbers on the UK’s train and bus networks. Rail bookings picked up last summer when lockdowns eased and we would expect a more significant rebound this year, assuming the UK government’s reopening plan proceeds as planned.

Trainline is a UK-listed technology platform that enables users to search and book rail tickets, both in the UK and increasingly across continental Europe too. For such platform companies, very little extra investment is needed for additional customers, which we believe subsequently drives profits and generates returns.

Meanwhile, a rebound in travel should be good news for catering outlets supplying food on the move. SSP Group operates outlets that may be familiar to the UK travelling public, such as Millie’s Cookies and Upper Crust. The company has sought fresh equity and refinanced its debt in order to weather the protracted lockdowns of the past year.

We believe equity investors can play an important role in the overall health of the UK economy by participating in equity raises. These raises are designed to ensure companies with bright future prospects are still in business to profit from the return of customers when the rules allow.

Focus on fitness

Health and wellness trends have grown in prominence over recent years and the pandemic has starkly highlighted the importance of good health. Gyms are already allowed to open part of their operations and, anecdotally, are seeing buoyant demand.

From an investment standpoint, gym operators offering low cost, no-contract, memberships are likely to find it easier to regain customers than those requiring people to sign up to lengthy contracts. The Gym Group is one such operator with low cost subscriptions.

Challenges remain in retail

Some retail companies with predominantly leasehold brick and mortar business models and weak balance sheets were under significant pressure prior to the pandemic.

In the short term we believe we may see footfall increasing as a result of the reopening, but the fundamental challenges facing the UK high street pre-date the pandemic and are unlikely to go away, in our view. Our belief is that those companies that do not improve sales densities and fail to successfully implement and scale online offerings could continue to struggle in the long term.

Growth not confined to reopening themes

The above gives a flavour of some of the diverse investment opportunities directly connected to the current lockdown lifting phase. However, these kinds of consumer-oriented industries are not the only areas that can benefit from the UK’s economic expansion.

For investors in small and midcap companies, we see a wide range of opportunities across different UK industries, including technology, industry and construction. Government initiatives to stimulate housing market activity should stand industrial and construction companies in good stead.

For more on these themes, see How can investors access the UK’s industrial recovery?

Rory Bateman is head of equities at Schroders

This article was published on 27 May 2021. Any company references are for illustrative purposes only and are not a recommendation to buy and/or sell, or an opinion as to the value of that company’s shares.

The article is not intended to provide, and should not be relied on, for investment advice or research.